Better insights for sharper risk decisions

Data insights

Primed for lasting impact

Put data to work for underwriting and claims management

Fragmented data and lagging insights can impede underwriting and claims performance. This leads to undetected risks, outdated pricing decisions, and missed opportunities for efficiency, ultimately putting pressure on profitability and growth.

With Digital Solutions

Get actionable insights for optimized insurance performance

Our advanced Life & Health insurance analytics and reporting platform transforms complex data sets into actionable insights, enabling optimized business performance. It processes and visualizes key indicators across underwriting, claims, and portfolio management, providing insights that drive consistent and confident decisions.

Product Capabilities

AI powered data intelligence is at the core of all our solutions

The data intelligence and reporting platform reveals opportunities to enhance underwriting, claims decisions, and understand consumer behaviours. Utilize near real-time dashboards, advanced analytics, and benchmarking tools to gain insights, optimize performance, and support informed decisions.

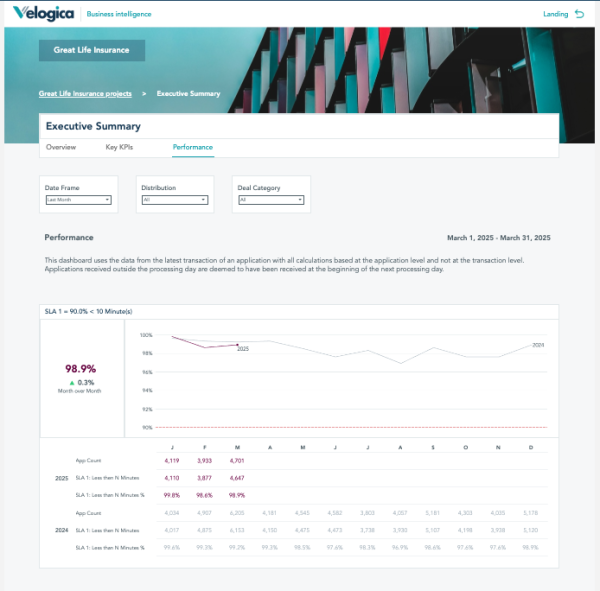

Reporting Dashboards

- Near real-time, role-based dashboards for underwriting, claims, and leadership.

- Visual portfolio health metrics and business performance trends, including STP rates, sum assured, volumes, outcomes, and claims processing times.

- Dynamic filtering and drill-down capabilities for deeper insights into your areas of interest, such as timescales, product focus, and demographic trends.

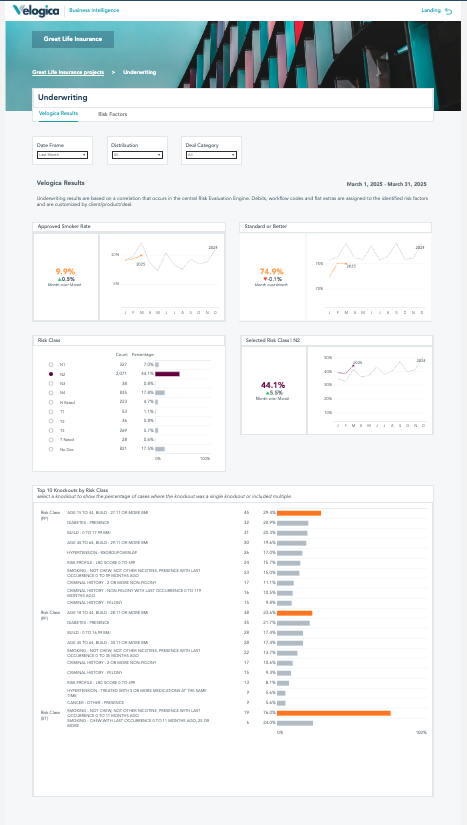

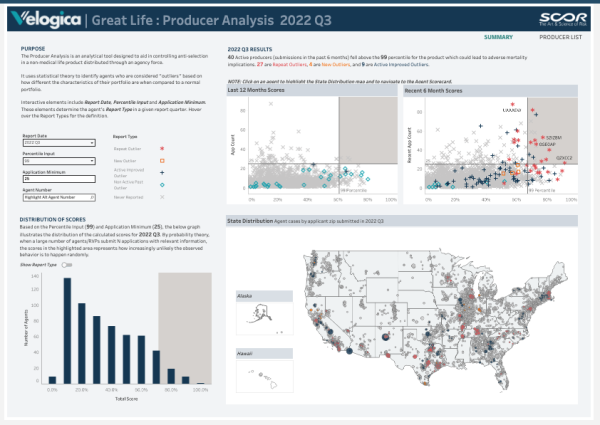

Advanced Analytics

- Predictive risk scoring and early detection of anomalies: High-risk application rate, rules performance accuracy.

- Disclosure trend monitoring and alerting: Disclosure pattern shift alerts.

- Advanced analytics application: Risk profiling and decision trend analysis to improve automation, enhance underwriting precision, and surface emerging risk patterns.

- Predictive model application: Accelerate decision-making, reduce manual interventions, and align underwriting actions with profitability goals.

- Demographic and behavioural diversity insights: Track key KPIs such as approval rates, automation levels, and risk segmentation by cohort.

Benchmarking

- Cross-portfolio comparisons and performance benchmarking: Peer comparison score, Portfolio Risk Deviation, Underwriter variation index, Efficiency index

- Compare your performance against industry standards and best practices: Benchmark your underwriting performance against industry standards to identify gaps, set realistic targets, and prioritize areas for improvement- whether it’s increasing STP rates, reducing time-to-decision, or tightening risk controls.

- Growth and improvement identification: pinpoint underperforming segments, uncover untapped customer profiles, and optimise decision rules to improve conversion and retention rates.

Benefits

Innovative analytics for better outcomes

READY FOR

DIGITAL SOLUTIONS?

We operate worldwide with

dedicated teams that you can reach directly.